All Categories

Featured

Nonetheless, these plans can be more intricate contrasted to various other kinds of life insurance policy, and they aren't necessarily right for every financier. Speaking with a knowledgeable life insurance policy agent or broker can assist you determine if indexed global life insurance coverage is a great suitable for you. Investopedia does not provide tax obligation, financial investment, or economic services and guidance.

, including a permanent life plan to their financial investment portfolio might make sense.

When comparing Indexed Universal Life to traditional life insurance, IUL stands out for its flexibility and growth potential. Indexed Universal Life offers more than just coverage; it’s a modern alternative to whole and term life.

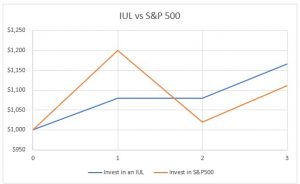

Unlike whole life insurance with fixed growth, Indexed Universal Life ties its cash value to a stock market index - IUL insurance for estate tax reduction with agents. Agents specialize in highlighting the differences between IUL and term life insurance

For example, Indexed Universal Life is better suited for retirement planning, while term life is focused on affordability. Whole life policies guarantee growth, but IUL offers tax advantages. Agents highlight Indexed Universal Life for tax-free withdrawals and premium flexibility.

Consult an experienced broker to compare IUL to other options based on your needs.

Low rates of return: Current research discovered that over a nine-year period, worker 401(k)s grew by approximately 15.6% each year. Compare that to a fixed rate of interest of 2%-3% on a permanent life policy. These distinctions include up with time. Applied to $50,000 in savings, the fees over would amount to $285 per year in a 401(k) vs.

In the exact same blood vessel, you could see financial investment development of $7,950 a year at 15.6% interest with a 401(k) contrasted to $1,500 each year at 3% rate of interest, and you 'd invest $855 more on life insurance policy every month to have entire life protection. For lots of people, getting long-term life insurance policy as component of a retirement is not a great idea.

Roth Ira Vs Indexed Universal Life: How To Choose The Best Option

Conventional financial investment accounts typically use higher returns and even more adaptability than whole life insurance coverage, but entire life can provide a relatively low-risk supplement to these retirement savings techniques, as long as you're certain you can manage the premiums for the lifetime of the plan or in this instance, till retirement.

Latest Posts

Index Life Insurance Pros And Cons

Term Vs Universal Life

Does Universal Life Insurance Expire