All Categories

Featured

Table of Contents

Various policies have different optimum levels for the amount you can spend, up to 100%., is added to the cash money value of the plan if the indexed account shows gains (generally calculated over a month).

This suggests $200 is included in the money worth (4% 50% $10,000 = $200). If the index drops in value or stays constant, the account nets little or nothing. There's one benefit: the insurance policy holder is shielded from sustaining losses. Although they carry out like protections, IULs are not considered investment safeties.

Having this implies the existing money worth is secured from losses in a poorly executing market., the client does not get involved in an adverse crediting rate," Niefeld stated. In various other words, the account will not shed its original money worth.

What Is Accumulation Value On Life Insurance

As an example, someone that develops the plan over a time when the market is performing poorly could end up with high costs repayments that don't add in all to the money value. The policy can then possibly lapse if the premium settlements aren't made on time later on in life, which might negate the point of life insurance policy altogether.

Insurance coverage firms typically set optimal participation rates of much less than 100%. These restrictions can restrict the actual rate of return that's attributed towards your account each year, regardless of how well the plan's hidden index does.

But it is very important to consider your personal threat resistance and financial investment goals to ensure that either one aligns with your overall technique. The insurance company makes cash by keeping a portion of the gains, consisting of anything over the cap. The attributing price cap may limit gains in a bull market. If the financier's cash is locked up in an insurance coverage, it can potentially underperform other investments.

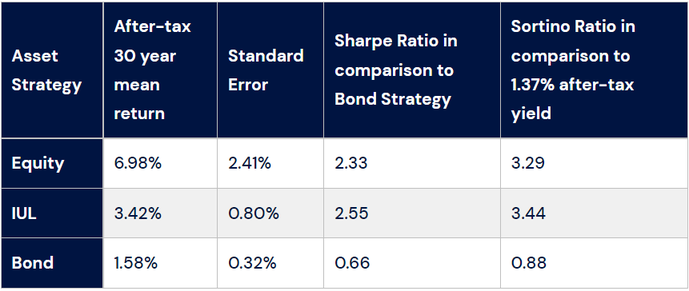

The possibility for a higher rate of return is one advantage to IUL insurance plan contrasted to various other life insurance policy plans. Nonetheless, bigger returns are not guaranteed. Returns can in truth be lower than returns on other items, depending upon how the marketplace executes. Insurance holders have to accept that danger for potentially greater returns.

In case of plan termination, gains come to be taxable as revenue. Losses are not deductible. Charges are commonly front-loaded and developed right into complicated attributing price calculations, which might confuse some financiers. Charges can be high. Costs vary from one insurance firm to the following and rely on the age and health and wellness of the insured.

In some cases, taking a partial withdrawal will certainly likewise completely minimize the death benefit. Terminating or surrendering a plan can cause more prices. In that instance, the cash money surrender worth may be less than the advancing premiums paid. Pros Supply higher returns than other life insurance policy policies Allows tax-free funding gains IUL does not decrease Social Safety and security benefits Plans can be designed around your danger appetite Cons Returns capped at a specific degree No assured returns IUL might have higher costs than other plans Unlike other kinds of life insurance policy, the value of an IUL insurance coverage policy is connected to an index linked to the stock market.

Universal Life Death Benefit Options

There are numerous various other sorts of life insurance coverage policies, described listed below. Term life insurance policy supplies a fixed benefit if the insurance holder dies within a set period of time, typically 10 to three decades. This is one of the most cost effective sorts of life insurance policy, as well as the most basic, though there's no money worth accumulation.

The plan gains value according to a fixed timetable, and there are fewer costs than an IUL insurance coverage. They do not come with the flexibility of adjusting costs. Variable life insurance policy features even more adaptability than IUL insurance, indicating that it is additionally more challenging. A variable plan's cash worth might rely on the performance of certain supplies or various other protections, and your costs can likewise change.

Remember, this kind of insurance coverage continues to be undamaged throughout your whole life just like other long-term life insurance coverage plans.

Adjustable Life Insurance Policies

Bear in mind, though, that if there's anything you're uncertain of or you're on the fencing about obtaining any kind of kind of insurance, be sure to speak with a professional. By doing this you'll know if it's affordable and whether it matches your economic plan. The price of an indexed global life plan depends upon numerous elements.

You will shed the fatality advantage called in the policy. On the other hand, an IUL comes with a death advantage and an added cash value that the insurance holder can obtain against.

Indexed global life insurance policy can aid you satisfy your household's demands for monetary defense while likewise constructing cash worth. These policies can be extra complex contrasted to other kinds of life insurance policy, and they aren't always right for every capitalist. Speaking to a skilled life insurance policy agent or broker can help you choose if indexed global life insurance is a good suitable for you.

Despite just how well you prepare for the future, there are events in life, both expected and unanticipated, that can influence the economic health of you and your loved ones. That's a factor forever insurance. Survivor benefit is typically income-tax-free to beneficiaries. The survivor benefit that's usually income-tax-free to your recipients can help guarantee your household will have the ability to keep their standard of life, aid them maintain their home, or supplement lost income.

Things like possible tax obligation rises, rising cost of living, financial emergency situations, and intending for events like college, retired life, or also weddings. Some kinds of life insurance policy can assist with these and other issues too, such as indexed global life insurance, or merely IUL. With IUL, your plan can be a financial resource, because it has the potential to build value gradually.

You can select to obtain indexed interest. Although an index might influence your rate of interest attributed, you can not invest or directly take part in an index. Here, your policy tracks, however is not really purchased, an exterior market index like the S&P 500 Index. This hypothetical example is provided for illustratory purposes just.

Guaranteed Ul Insurance

Fees and expenditures may decrease policy worths. Due to the fact that no single allocation will certainly be most effective in all market settings, your monetary expert can aid you establish which combination may fit your economic objectives.

That leaves extra in your policy to potentially maintain expanding over time. Down the road, you can access any kind of readily available cash value via plan financings or withdrawals.

Talk to your economic specialist concerning just how an indexed universal life insurance coverage policy could be component of your overall financial strategy. This web content is for basic educational functions just. It is not intended to give fiduciary, tax, or legal recommendations and can not be utilized to prevent tax obligation charges; neither is it meant to market, advertise, or suggest any kind of tax strategy or setup.

Insurance Index

In case of a gap, outstanding plan fundings in excess of unrecovered expense basis will certainly undergo normal income tax. If a plan is a customized endowment contract (MEC), plan loans and withdrawals will be taxable as regular income to the extent there are earnings in the plan.

These indexes are standards only. Indexes can have different constituents and weighting methods. Some indexes have multiple variations that can weight elements or might track the influence of dividends in different ways. Although an index may influence your passion credited, you can not purchase, straight join or obtain reward repayments from any of them with the policy Although an outside market index might impact your interest attributed, your plan does not directly take part in any stock or equity or bond investments.

This web content does not apply in the state of New york city. Assurances are backed by the financial toughness and claims-paying capacity of Allianz Life Insurance Coverage Firm of North America. Products are provided by Allianz Life insurance policy Business of The United States And Canada, 5701 Golden Hills Drive, Minneapolis, MN 55416-1297. .

Life Insurance Stock Index

The details and summaries consisted of here are not planned to be full descriptions of all terms, conditions and exclusions relevant to the services and products. The specific insurance coverage under any COUNTRY Investors insurance policy product goes through the terms, problems and exemptions in the real policies as issued. Products and solutions defined in this web site differ from one state to another and not all items, coverages or solutions are offered in all states.

Your current browser could restrict that experience. You might be utilizing an old internet browser that's unsupported, or settings within your browser that are not compatible with our website.

Dow Jones Life Insurance Index

Already utilizing an upgraded browser and still having trouble? Please give us a phone call at for additional assistance. Your current internet browser: Discovering ...

Latest Posts

Index Life Insurance Pros And Cons

Term Vs Universal Life

Does Universal Life Insurance Expire