All Categories

Featured

Table of Contents

The vital difference in between common UL, Indexed UL and Variable UL hinges on exactly how money worth buildup is determined. In a conventional UL policy, the cash money value is assured to grow at a rate of interest rate based upon either the existing market or a minimal interest rate, whichever is greater. So, for instance, in a common Guardian UL policy, the yearly rate of interest will never ever go reduced than the current minimum price, 2%, yet it can go higher.

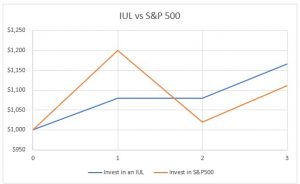

In a negative year, the subaccount value can and will lower. These plans allow you allocate all or part of your cash worth growth to the efficiency of a broad securities index such as the S&P 500 Index. 7 Nonetheless, unlike VUL, your money is not actually purchased the marketplace the index simply gives a recommendation for just how much rate of interest the insurance debts to your account, with a floor and a cap for the minimum and optimum prices of return.

Usually, you'll additionally be able to allot a section to a fixed-rate interest account. The cap is typically max credit score for a specified sector of index participation. Many plans have yearly caps, but some policies might have month-to-month caps. Caps can transform at the end of any kind of sector. In addition, upside performance can be influenced by a "participation rate" set as a portion of the index's gain.

Many Indexed UL plans have a participation price established at 100% (significance you understand all gains up to the cap), but that can change. Assuming you made no modifications to your allowance, right here's what would certainly have happened the next year: 80% S&P 500 Index$8,000 +24.2%100%11%11%$880$8,88020% Fixed-rate$2,060 NANA3%$62$2,122 Over this uncommonly volatile two-year period, your typical money worth development rate would have been close to 5%.

Like all other forms of life insurance policy, the main purpose of an indexed UL policy is to provide the monetary protection of a death benefit if the policyholder passes away unexpectedly. Having stated that, indexed UL policies can be particularly appealing for high-income people who have maxed out various other retirement accounts.

How To Get Out Of Universal Life Insurance

Nevertheless, there are additionally essential tax effects that insurance policy holders need to know. For one, if the policy gaps or is given up with an impressive car loan, the car loan amount may come to be taxed. You should additionally learn about the "Internal Revenue Service 7-Pay Examination": If the cumulative premiums paid during the first 7 years go beyond the quantity needed to have the plan paid up in seven level annual payments, the plan ends up being a Modified Endowment Contract (or MEC).

So it's important to get in touch with a monetary or tax expert that can assist guarantee you optimize the advantages of your IUL policy while remaining compliant with IRS guidelines. Since indexed UL plans are somewhat intricate, there tend to be greater administrative fees and expenses compared to other types of irreversible life insurance such as entire life.

This marketing widget is powered by, a qualified insurance manufacturer (NPN: 8781838) and a corporate affiliate of Bankrate. The deals and clickable web links that appear on this ad are from firms that make up Homeinsurance.com LLC in various methods. The settlement received and various other elements, such as your place, may impact what advertisements and web links appear, and exactly how, where, and in what order they show up.

We make every effort to maintain our info accurate and up-to-date, however some info might not be existing. Your real deal terms from a marketer might be various than the offer terms on this widget. All offers might go through added terms and problems of the advertiser.

When planning for the future, you intend to attempt to offer yourself the best possible opportunity for peace of mind, and financial safety for you and your loved ones. This usually calls for some mix of insurance and investments that have good development capacity over the longer term. What if we told you there was a life insurance coverage option that incorporates peace of mind for your liked ones when you pass along with the opportunity to generate extra revenues based on particular index account performance? Indexed Universal Life insurance policy, commonly abbreviated as IUL or described as IUL insurance policy, is a vibrant blend of life insurance coverage and a cash worth component that can grow relying on the performance of prominent market indexes.

IUL insurance is a type of long-term life insurance. The defining trait of an IUL policy is its growth potential, as it's connected to particular index accounts.

Best Universal Life Insurance Companies

Death benefit: A characteristic of all life insurance policy items, IUL plans additionally guarantee a survivor benefit for beneficiaries while coverage is active. Tax-deferred development: Gains in an IUL account are tax-deferred, so there are no prompt tax obligation commitments on accumulating profits. Loan and withdrawal choices: While obtainable, any type of monetary interactions with the IUL policy's cash worth, like financings or withdrawals, need to be come close to carefully to avoid diminishing the survivor benefit or incurring tax obligations.

Growth capacity: Being market-linked, IUL policies might produce better returns than fixed-rate financial investments. Shield against market slides: With the index attributes within the product, your IUL plan can continue to be insulated against market drops.

Lesser amounts are offered in increments of $10,000. Under this strategy, the chosen insurance coverage takes impact two years after enrollment as long as premiums are paid during the two-year duration.

Coverage can be extended for up to 2 years if the Servicemember is totally impaired at separation. SGLI coverage is automatic for most active obligation Servicemembers, Ready Reserve and National Guard participants scheduled to carry out at the very least 12 durations of non-active training per year, participants of the Commissioned Corps of the National Oceanic and Atmospheric Management and the Public Wellness Solution, cadets and midshipmen of the U.S.

VMLI is offered to Professionals that received a Specifically Adapted Housing Grant (SAH), have title to the home, and have a home loan on the home. near brand-new enrollment after December 31, 2022. We started accepting applications for VALife on January 1, 2023. SGLI insurance coverage is automated. All Servicemembers with permanent protection need to utilize the SGLI Online Registration System (SOES) to mark recipients, or decrease, decrease or recover SGLI insurance coverage.

Equity Index Life Insurance

Members with part-time coverage or do not have accessibility to SOES need to use SGLV 8286 to make modifications to SGLI. Complete and documents type SGLV 8714 or get VGLI online. All Servicemembers should use SOES to decline, reduce, or recover FSGLI insurance coverage. To access SOES, most likely to www.milconnect.dmdc.osd.mil/milconnect/. Participants who do not have accessibility to SOES need to use SGLV 8286A to to make adjustments to FSGLI coverage.

After the initial plan year, you might take one annual, cost-free partial withdrawal of up to 10% of the total build-up worth with no surrender charges. If you take out even more than 10% of the buildup value, the cost puts on the quantity that goes beyond 10%. If you make greater than one partial withdrawal in a policy year, the charge uses to the quantity of second and later withdrawals.

The continuing to be money can be bought accounts that are tied to the efficiency of a stock market index. Your principal is guaranteed, however the amount you make undergoes caps. Financial coordinators generally recommend that you very first max out other retired life savings options, such as 401(k)s and IRAs, prior to considering investing via a life insurance policy policy.

Latest Posts

Index Life Insurance Pros And Cons

Term Vs Universal Life

Does Universal Life Insurance Expire