All Categories

Featured

There is no one-size-fits-all when it comes to life insurance coverage. Getting your life insurance policy plan right takes into account a variety of variables. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your busy life, monetary independence can appear like an impossible goal. And retirement might not be top of mind, since it appears up until now away.

Pension plan, social protection, and whatever they 'd managed to save. It's not that simple today. Fewer companies are supplying conventional pension and many business have decreased or terminated their retirement and your ability to rely solely on social protection is in inquiry. Also if advantages have not been decreased by the time you retire, social safety alone was never ever intended to be sufficient to pay for the lifestyle you want and should have.

/ wp-end-tag > As component of an audio monetary technique, an indexed global life insurance coverage plan can assist

you take on whatever the future brings. Prior to dedicating to indexed universal life insurance coverage, right here are some pros and disadvantages to consider. If you select an excellent indexed global life insurance coverage strategy, you may see your cash money worth grow in worth.

Nationwide Yourlife Indexed Ul Accumulator

Given that indexed universal life insurance requires a particular degree of risk, insurance coverage business often tend to maintain 6. This type of strategy additionally offers.

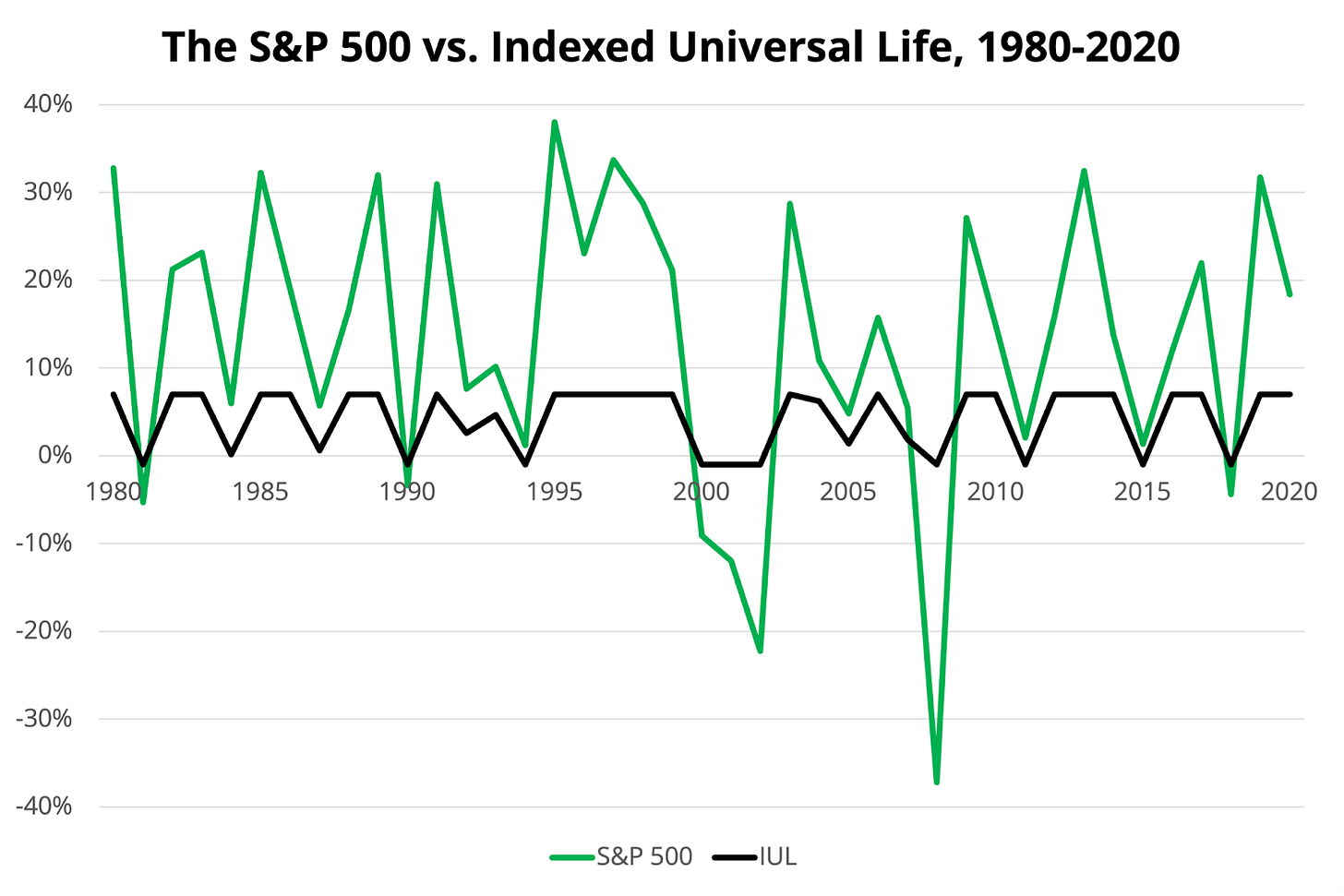

If the selected index does not execute well, your cash money worth's growth will be impacted. Normally, the insurance policy company has a beneficial interest in performing better than the index11. Nevertheless, there is usually a guaranteed minimum rate of interest, so your strategy's growth won't fall listed below a particular percentage12. These are all elements to be thought about when choosing the very best kind of life insurance policy for you.

Nationwide Single Premium Ul

:max_bytes(150000):strip_icc()/dotdash-comparing-iul-insurance-iras-and-401ks-Final-71f14693e37d4fb1b0736112179802b5.jpg)

However, because this kind of plan is extra complex and has a financial investment element, it can frequently include greater costs than other policies like entire life or term life insurance policy. If you do not believe indexed universal life insurance policy is best for you, right here are some alternatives to consider: Term life insurance policy is a temporary plan that normally offers protection for 10 to three decades.

Indexed universal life insurance coverage is a sort of plan that provides much more control and flexibility, along with greater money value growth capacity. While we do not offer indexed global life insurance policy, we can provide you with even more info about whole and term life insurance policy policies. We suggest discovering all your choices and talking with an Aflac representative to find the very best fit for you and your family.

The remainder is contributed to the cash worth of the plan after fees are subtracted. The money value is credited on a month-to-month or yearly basis with rate of interest based on increases in an equity index. While IUL insurance may show important to some, it is essential to comprehend how it works before buying a policy.

Latest Posts

Index Life Insurance Pros And Cons

Term Vs Universal Life

Does Universal Life Insurance Expire